Embarking on a Financial Management Journey

Navigating personal finances is essential in today’s world, and finding the Simple Budget App for Financial Management is key for individuals who aim to effortlessly oversee their expenditures. The utilization of budget applications is becoming increasingly vital as a tool for ensuring financial stability.

Valuing an Intuitive User Experience

A budget application must be user-friendly, boasting an interface that is both appealing and functional. The ultimate goal is to provide users with the capability to easily manage their financial information with minimal effort or previous knowledge.

Essential Attributes of a Reliable Budget App

Several features are considered indispensable when it comes to selecting a budgeting app:

- Data Security: Protecting sensitive financial information is crucial, necessitating stringent security protocols.

- Instantaneous Expense Logging: The ability to record expenses in real-time ensures your financial overview remains current.

- Tailored Budget Categories: The capacity for customization accommodates the diverse financial conditions of users.

- Insightful Reporting: In-depth reports are instrumental for analyzing expenditure patterns.

Leading Budget Apps to Consider

We examine leading options that offer varying functionalities suitable for different preferences.

Budgeting Made Simple: Simplifi by Quicken

Simplifi by Quicken simplifies the budgeting process, ideal for novices. It features a clear layout and forecasting notifications to maintain financial balance.

The Purist’s Preference: Goodbudget

Goodbudget adapts the traditional envelope system, offering a back-to-basics approach to financial tracking for users who favor simplicity.

Digital Financial Expertise: YNAB

YNAB caters to those who take pleasure in detailed financial planning with a suite of educational tools at their disposal.

The Comprehensive Solution: Mint

Mint stands out for its holistic view of one’s finances, complete with categorization and alerts designed to curb excessive spending.

Benefiting from a Streamlined Budget Application

The advantages of employing a streamlined budget application include enhanced financial clarity, disciplined purchasing habits, cost-reduction strategies, and realistic savings objectives.

Incorporating a Budget Tool into Daily Routines

Seamless integration of a budget tool within daily activities is fundamental for its effectiveness, whether through manual data entry or automated bank synchronization.

Additional Resources and Support

Top-tier applications extend their offerings to educational content and dedicated support teams that enrich the user’s fiscal acumen.

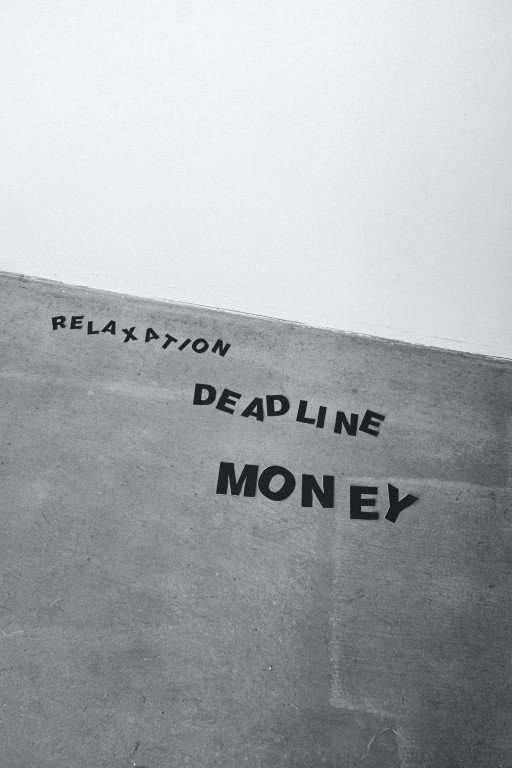

Interpreting Financial Data Visually

Advanced budget apps convert raw figures into visual representations such as charts, aiding users in identifying potential savings.

Further reading on financial management can provide additional context and insights.

Ensuring Cross-Platform Continuity

The modern user expects financial information to be synchronized across various devices, enhancing accessibility and convenience.

Commitment to Innovation and Growth

Continuous improvement of the app through updates reflects the developer’s dedication to user satisfaction and adaptability.

tips personal finance mastery spending tracker apps

Evaluating Your Best Budget App Option

Conducting a comparative analysis helps pinpoint the app that aligns with one’s individual financial requirements and aspirations.

User Feedback and Achievements

Testimonials are invaluable when gauging the potential fit and effectiveness of a budget app for your own financial journey.

Choosing the Right Budget App

Take into account your financial behaviors, tech savvy, and goals when selecting a budget app that corresponds with your personal and fiscal priorities.

Conclusion: Seizing Financial Control

To conclude, the Simple Budget App for Financial Management that echoes your monetary perspective is instrumental in mastering your financial destiny, propelling you towards true economic emancipation.